bradford tax institute ppp

Small business administrations sba form 3508 ppp forgiveness application state. The ppp extension act of 2021 makes paycheck.

Nearly A Quarter Of Nc House Members Have Close Ties To Companies With Ppp Loans

The maximum loan attributable to and forgiveness available for the compensation paid to any SBA-defined owner-employee across all businesses is 1 15385 for borrowers.

. Bradford Tax Institute Blog Operations 1050 Northgate Drive Suite 351 San Rafael CA 94903 E-Mail. 351 san rafael ca 94903 telephone. If thats the case Uncle Sam has some good news for you.

If you failed to apply for your money in the first round of the PPP payout you missed a terrific opportunity. As a super high authority website that earned its reputation online a long time ago it is no surprise that our VLDTR tool.

Ppp Loan Forgiveness Tax Plan For This Now Unbehagen Advisors

Bradford Tax Institute Facebook

Economics May Not Be Driving Corporate Generosity The Washington Post

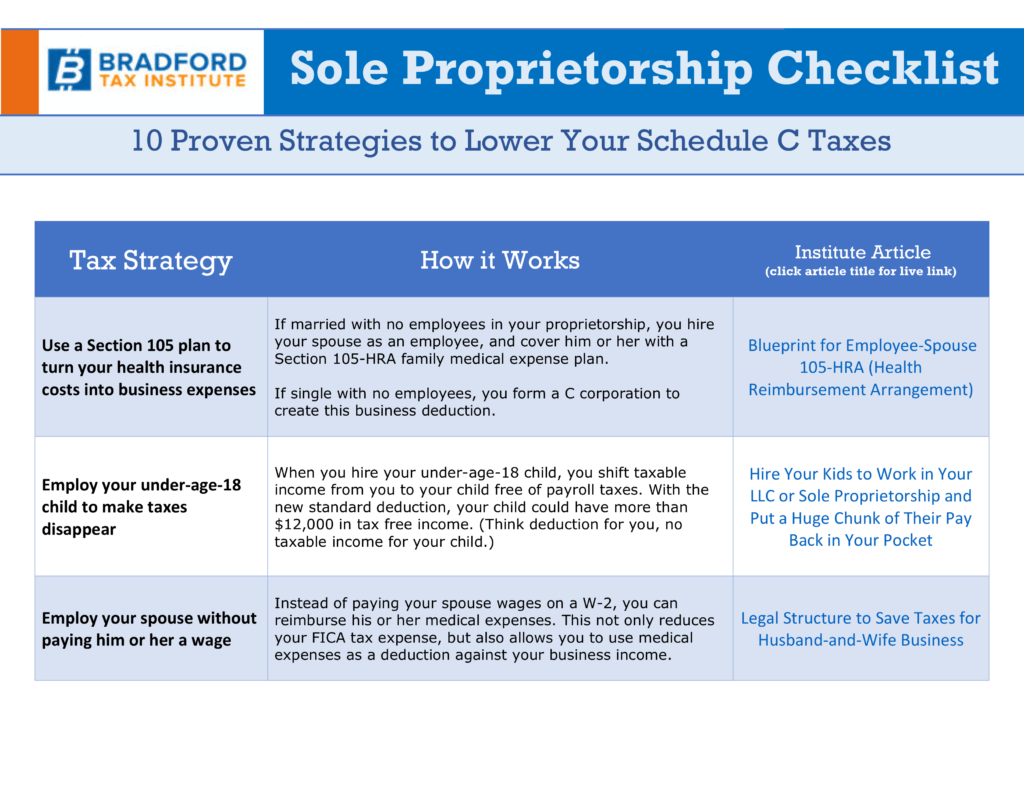

Free Checklist 10 Proven Tax Reduction Strategies For Sole Proprietors

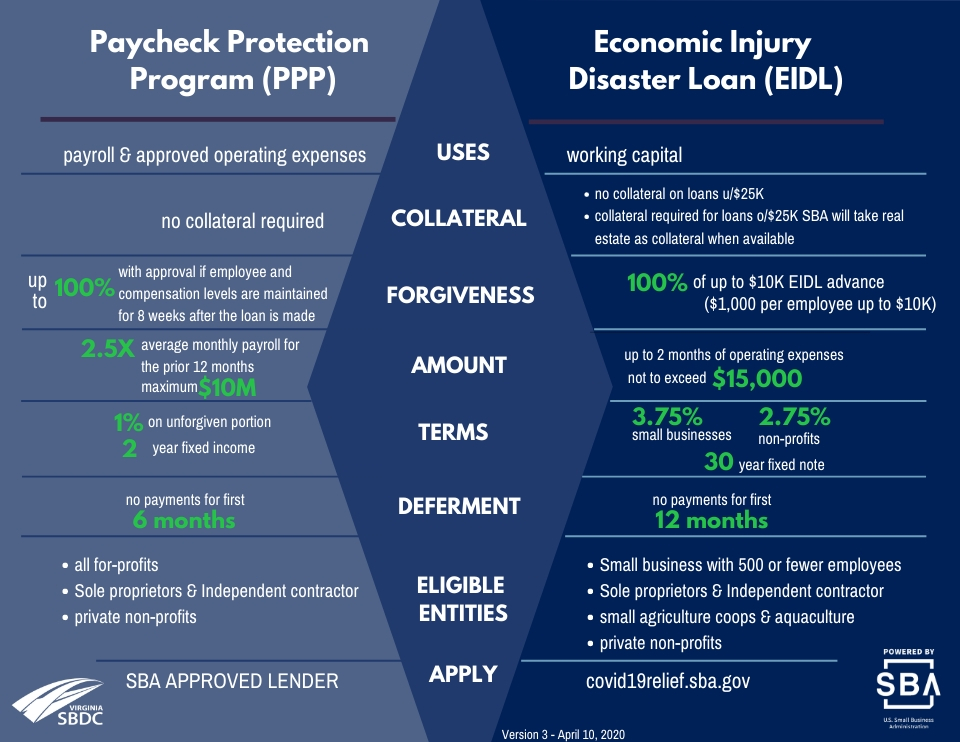

Business Support Blog During Covid 19 Small Business Development Center

Sba Clarifies Ppp Loan For The Self Employed With No Employees

Self Employed During The Pandemic Uncle Sam Didn T Forget About You

Bradford Tax Institute Facebook

Bradford Tax Institute Facebook

Free Checklist 10 Proven Tax Reduction Strategies For Sole Proprietors

State Tax Cut For Ppp Loans Clears Big Hurdle Coronavirus Unionleader Com

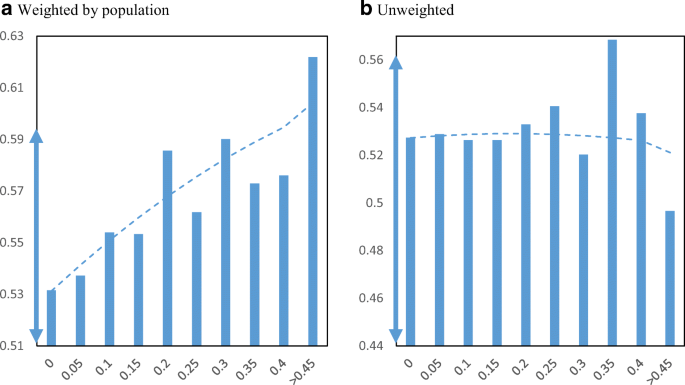

Did The Paycheck Protection Program And Economic Injury Disaster Loan Program Get Disbursed To Minority Communities In The Early Stages Of Covid 19 Springerlink

Anyone Use Bradford Tax Institute R Taxpros

Sba Ppp Loans Could Lead To Big Tax Bill For Small Businesses Washington Business Journal

Business Support Blog During Covid 19 Small Business Development Center

School Choice In The Post Pandemic Era Harvard Kennedy School

30th Annual Institute On Advising Nonprofit Organizations In Colorado Cle